- A 358-page document released to The Canadian Jewish News details how the Canada Revenue Agency lost patience with Jewish National Fund of Canada

- Since 2019, JNF Canada has known its status would be revoked, along with an earlier series of warnings

- The charity admitted its iconic tree-planting campaigns were a fundraising “gimmick”

- It’s true: building projects on IDF bases and in the West Bank were a red flag

- JNF Canada CEO Lance Davis can be heard on the Aug. 27 edition of The CJN Daily podcast with Ellin Bessner—and additional comments from Davis are included in our follow-up article

- What do loyal JNF Canada donors think? We talked to a couple of them on The CJN Daily

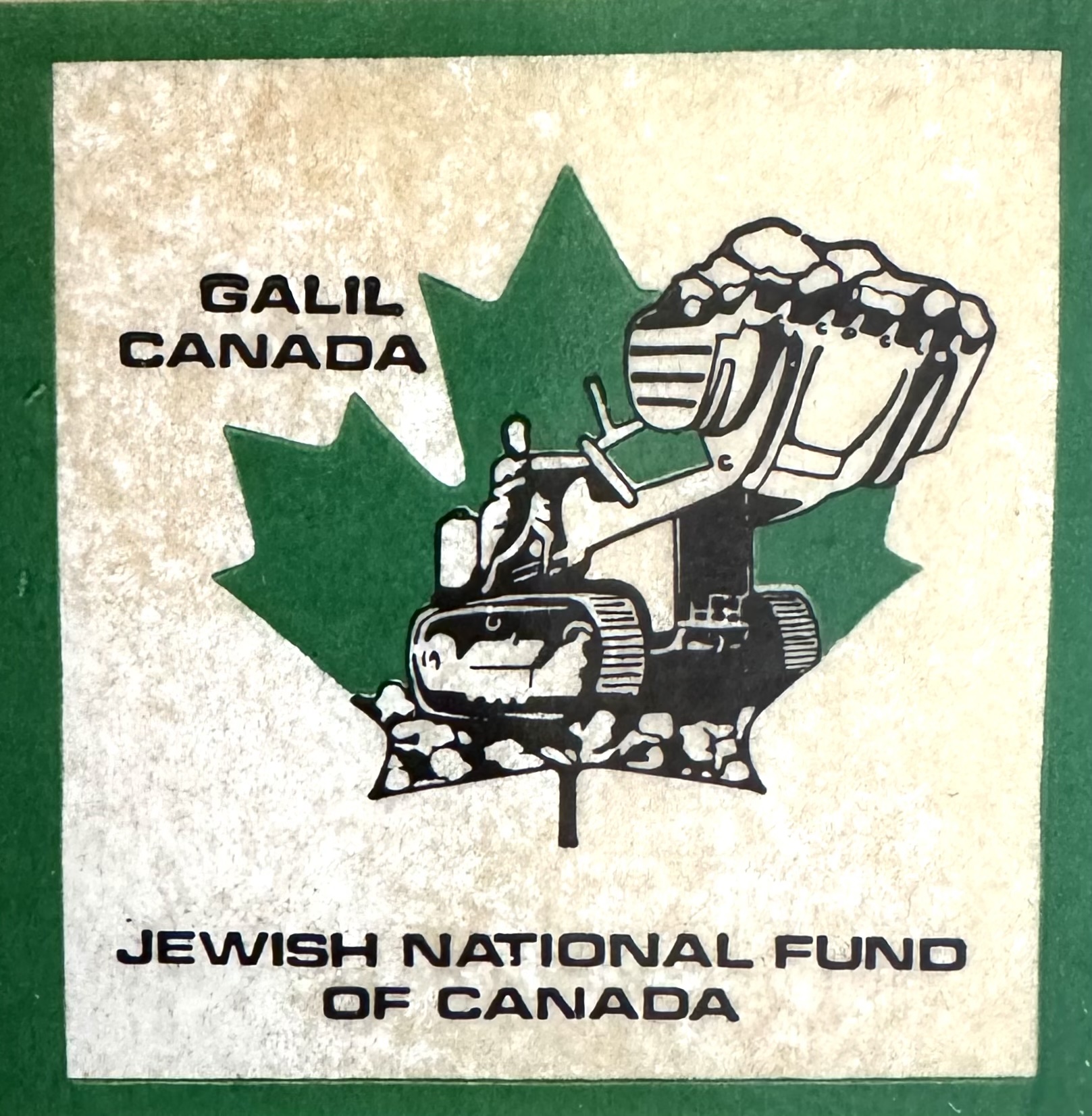

Jewish National Fund of Canada has known for years that Canada’s tax agency had “major concerns” with how the charity operates, The Canadian Jewish News has learned.

Canada Revenue Agency (CRA) warned JNF Canada in 2019 it planned to take away its charitable status and then warned them again in 2023 and in 2024, due to “repeated and serious non-compliance” with the Income tax Act rules governing charities, particularly covering JNF Canada’s work in Israel.

Documents recently released to The CJN by the CRA show the venerable Canadian Jewish charity–that has helped reforest and build infrastructure in Israel since the late 1960s—had been warned repeatedly to clean up its act between 2016 and 2023, and even earlier.

“The CRA letter dated Aug. 21, 1989, raised concerns about the [JNF Canada’s] direction and control, and maintenance of books and records,” according to the CRA documents. “The major concerns about the Organization’s activities overseas have been present since the first audit.”

The communications branch of the CRA recently provided 358 pages of its correspondence with JNF Canada. Officials said that due to confidentiality restrictions in the Income Tax Act, the CRA can release this material only after revoking a charity’s status. (The charity was always able to release the documents itself—but JNF Canada has not.)

JNF Canada’s charitable status changed on Aug. 10, when the CRA formally revoked the charity’s ability to issue tax receipts as a registered charity by publishing a notice in the Canada Gazette, the official organ of the Canadian government.

Barring any future legal reversals which JNF Canada may obtain through the courts, the revocation order means the charity is now unable to issue any tax-exempt donation receipts, or to receive tax-exempt donations or gifts from other registered Canadian charities. It must wind up its charitable business within one year, dispose of its $30 million in assets, or risk paying a 100 percent tax.

With the CRA’s release of its correspondence with JNF Canada, we can follow the paper trail of how the tax department eventually lost its patience, after nearly 10 years of trying to get the charity to prove it deserves to issue tax receipts to Canadian donors in exchange for their generosity.

The reasons for JNF’s revocation

The current issues raised by the CRA range from:

- The auditors doubting that JNF Canada carries out its founding charitable purpose

- The charity not being able to prove it maintained proper control and direction over where or how its on-the-ground agents in Israel, mainly the Jerusalem-based Keren Kayemeth LeIsrael/Jewish National Fund, were using the Canadian money

- Concerns over missing records, superficial paperwork and travel expenses for Canadian office staff

- Why financial records were kept in Israel only, which is illegal

- Why documents were provided to auditors only in Hebrew

- Accusations that JNF Canada was deliberately stalling on addressing the agency’s concerns dating back to the most recent audit, begun in 2014

The Jewish charity proudly stated in 2021 that, since the year 2000, it has sent at least $200 million to Israel, collected from 20,000 donors in support of more than 180 environmental and social projects.

While JNF Canada has called the government’s revocation move “biased”, unduly rushed, and deliberate –and some supporters believe the motivation was even antisemitic–pro-Palestinian activists in Canada are crediting themselves for influencing the government auditors and their superiors to crack down, after a multi-year campaign called #StopJNFCanada.

Independent Jewish Voices, which supports boycott, divestment and sanctions against Israel, the Green Party of Canada, Just Peace Advocates, as well as the federal NDP, are among the groups that have long called for a crackdown on the charity due to JNF Canada’s past support for building projects on land in the West Bank, and on Israel Defense Forces (IDF) military bases.

But the government agency, which regulates around 86,000 Canadian charities, denies this was the reason why it pulled the plug now.

On June 26, 2024, the CRA sent the charity a “notice of confirmation” letter to formalize the earlier letter, dated Aug. 20, 2019 announcing a notice of intention to revoke.

The agency’s Holly Brant, who managed the appeals section of the CRA’s Charities Directorate, wrote that they most certainly were not bowing to public pressure. Rather, it was because there were the same fundamental problems there had always been.

“The audit results are based on information determined from the books and records of the Organization and not from the campaigns and complaints received by CRA,” she writes. “Therefore the standards and approach used for this audit were appropriate and followed CRA procedures.”

For the better part of three years, beginning in 2016, the parties discussed solutions to problems uncovered in the recent audit. In 2019, CRA told JNF Canada it was going to revoke. After that, the letters stop. Three and a half years go by. Then, in February 2023, the auditors gave the charity one more chance.

JNF Canada was asked to send in more complete paperwork about two marquee construction projects in Israel, including a therapeutic garden for patients at the Eitanim Psychiatric hospital in the Jerusalem hills. The agency reported back that JNF Canada not only sent them nothing new that was useful, but curiously sent in the paperwork for a completely different project instead.

“We remain of the opinion that the activities of the Organization are not charitable, that the information about the eligible beneficiaries are lacking and that the Organization does not have direction and control over its funds sent to Israel,” the CRA replied, confirming the revocation of its status.

Clashing over charitable purpose

According to the CRA’s documents, the tax department has long taken issue with JNF Canada’s 57-year old founding charitable purpose.

Until the 1960s, Canadian Jews had directly supported the Jerusalem-based Keren Kayemeth LeIsrael (KKL) organization founded by Theodor Herzl in 1901 to reclaim the land and plant trees. It would only be in 1961 when an independent Canadian branch of the Jewish charity was formally created. It was based in Montreal, with its own bank accounts and board of directors.

In 1967, the Canadian entity applied to the revenue department to register JNF Canada as a Canadian charity, giving it the ability to issue tax receipts for donation—as long as JNF Canada complied with the income tax laws.

These laws required JNF Canada to restrict itself to carrying out exclusively charitable activities, and meet at least one of the government’s accepted categories of humanitarian purposes. In JNF Canada’s case, this purpose was to be “relief of poverty.”

How they would do that, documents show, was not by actually paying for trees or parks, but rather for the labour costs of needy “indigent workers”, who came as immigrants from “backward Middle East and North African countries and countries of eastern Europe” who JNF Canada said suffered physical or emotional disabilities and would otherwise be unemployable in the regions where they were living.

However, the charity realized that it would have a hard sell embarking on fundraising campaigns if it were known that the money was going to pay workers.

So, they admitted to the government they would instead appeal for money in a different way, keeping public relations techniques in mind.

Tree planting was ‘a gimmick’

JNF Canada tells donors it has planted more than 2 million trees in Israel to date.

But documents show JNF Canada hasn’t been transparent in how it was approaching donors. It is a criticism which the charity didn’t dispute.

“Experience has shown the Charity that donors are more likely to provide donations for charitable projects than simply relieving poverty through the employment of Indigent Workers,” JNF Canada wrote to the CRA Charities Director in Ottawa in 2018.

Indeed, as far back as July 21, 1967, JNF Canada’s founders (whose names were not listed in the documents) told the revenue department as much.

“I have put the word ‘planted’ in quotation marks. You will recall that on the phone I referred to the practice of ‘planting’ trees as a ‘gimmick’. Actually, all monies raised by the Jewish National Fund of Canada are used to pay daily stipends to indigent workers. So we ‘plant’ the trees to the extent that we give a tree certificate to the donor and use the money to give employment to the man who is doing the planting.”

In the first years of the charity’s projects in Israel, this per diem wage amounted to about $5 per day, the CRA was told.

The CRA allowed this, but then documents reveal, became increasingly unconvinced.

Auditors felt JNF Canada couldn’t show it was keeping close enough tabs on the people truly running the projects over in Israel, namely the KKL/JNF. Despite this issue being raised in several audits, no sanctions were issued. The minister closed the files in the mid-1980s as part of a widespread amnesty for all charities, documents show.

But with the last audit beginning in 2014, the CRA documents give a clearer picture of how the relationship with JNF Canada began to unravel.

That audit took a look at the charity’s books for the years 2011 and 2012.

The auditors couldn’t reconcile the paperwork and records it got from the charity with what JNF Canada said it was actually doing in Israel. Further, the auditors felt JNF Canada was no longer meeting its stated historic charitable purpose, for which the tax department had granted it the right to operate.

While paying workers’ salaries was admirable, truly preventing poverty meant JNF Canada’s money had to do more for poor workers. These workers should have received help with their resumes, the auditors said, and been offered career counselling courses and vocational training, the CRA told them.

When the charity didn’t send back the kind of paperwork CRA asked for, despite repeated requests, the auditors came to feel JNF Canada was actually just providing the Israel-based workers with a private benefit—and also providing the projects’ Israeli overseers, who until recently was mainly the KKL—with a private benefit, by covering labour costs.

The CRA wrote that it understood JNF Canada did not “employ the Indigent Workers directly, and had no legal or beneficial title to the work product” but rather took credit for the work as “a gimmick designed to encourage donations and show appreciation for Canadian donees.”

The revenue agency then took issue with JNF’s public but non-binding mission statement at the time, which was: “to provide funds to Keren Kayemeth Le’lsrael (KKL) to redeem the land of lsrael, to connect Canadian Jewry to their national homeland and to their partnership in its development, and to emphasize the centrality of Israel to Jewish life.”

These three goals, the CRA felt, were not “relief of poverty” but unstated “non-charitable purposes” and would disqualify JNF Canada from being a registered charity. Canada doesn’t consider the KKL in Israel a qualified recipient of charity.

A second concern the CRA expressed was that it wanted more detailed proof that the workers–who in later years have mainly hailed from Ethiopia and Russia—were actually eligible beneficiaries of this money. Auditors repeatedly asked for better receipts that would show timesheets, projects, workers’ names and family situations.

It wanted to know whether it was JNF Canada or the KKL who was actually doing the vetting and whether anyone checked whether these workers had used up all their national unemployment benefits and were now receiving Israel’s version of welfare.

Who directed and controlled donations?

For the last ten years, and even as far back as 1989, the CRA and the Canadian charity have been at odds over whether ultimate direction and control was done by JNF Canada, or by the KKL in Israel, which for decades had been overseeing everything as JNF Canada’s main agent.

JNF Canada told the tax department that it had a committee of Canadian expatriates living in Israel, who served on a voluntary basis, and acted as an on-site board of directors. They had a name, CANISCOM. They liaised with KKL’s Canada Desk bureau, and wrote up brief minutes of their twice-yearly site visits.

Staff from JNF Canada’s head office also paid regular visits to Israel to check on things.

But CRA still wasn’t satisfied that the Canadians had real input into the work KKL was already doing.

“The audit did not reveal any evidence to show that these payments constituted charitable expenditures by the Organization towards its own programs. The audit findings seem to suggest that these payments were simply unregulated payments to KKL,” the CRA writes.

Auditors slammed the Canadians for not bothering to ask the KKL to send back the required paperwork during the final years before revocation.

“As a result, we are of the view that the Organization did not maintain adequate books and records to substantiate that its resources were devoted to its own charitable programs.”

Agreements drafted six years ago

In 2018, JNF Canada drafted a series of “robust” general agency agreements that it promised the CRA it would start using with its agents in Israel.

These agreements would go a long way to tighten up oversight and accountability, including eliciting guarantees, the charity said. The charity also pledged to have these contracts translated into English.

But in 2023, four years after the original revocation notice, the CRA gave JNF Canada one more chance.

It was to provide complete documentation for two of its most recent projects: the therapeutic nature garden at the Eitanim Psychiatric Hospital in the Jerusalem Hills, (for which the Canadian comedy duo of YidLife Crisis produced a JNF Canada virtual event in 202), and the Kiryat Malachi Accessible Playground, donated in part by Toronto’s Mary Ellen Herman and family, in memory of her late daughter. The playground had its ribbon-cutting in December 2022.

According to the auditors, JNF Canada didn’t send them anything new, and what they did send raised more red flags. The auditors discovered JNF Canada’s new “agency agreements” still weren’t being used. The CRA also said JNF Canada failed to live up to its promises to review the invoices it got from Israel before handing over any money.

In the case of the Eitanim Psychiatric Hospital in the Jerusalem Hills, to which JNF Canada sent a one-time payment to KKL/JNF of $300,000, CRA found that this project was already well underway before JNF Canada ever got involved.

The auditors concluded JNF Canada could not guarantee it had any control over where the money was to be used.

“It is only expected that the funds would be used for this project. It is reasonable to conclude that funds could be used for other purposes by the recipient for other activities,” the CRA wrote, pointedly underlining the word “expected.”

The CRA had harsh words for JNF Canada’s behaviour:

“It is our opinion that the Organization is avoiding addressing the audit findings by creating various types of agreement (sic) with its agent in Israel. Furthermore, we found various issues with the different agreements created by the Organization. These issues were not addressed by the Organization aside from saying that they were no longer valid and replaced by another agreement. The non-compliance findings were significant, and proper documentation of the Organization activities in Israel was not provided.”

Digging into books and records

Here’s another example of what bothered the auditors when they dug deeper in 2023.

Instead of providing receipts for the Eitanim psychiatric facility in West Jerusalem, CRA says it received receipts for a JNF Canada project at the Herzog Medical Center, a large Israeli hospital located 14 kilometres in the other direction.

“The Herzog Medical Center was located at Givat Shmuel in Jerusalem while the Eitanim Psychiatric Hospital is located at 91060 HaRav Raphael Katsenelbogen Street in Jerusalem. Therefore, it appears that these two entities are distinct from one another and we do not understand why these supporting documents were provided for this project if they are not the same entities.”

JNF Canada did indeed fund a major construction project at Herzog, starting in 2014, when the current national CEO, Lance Davis was executive director of JNF Canada’s Toronto branch. The project is a $10-million mental health centre named for lead donors Max and Gianna Glassman, which is focused on treating PTSD. The building opened in December 2022. (Max Glassman, a well-known philanthropist in Toronto, passed away in 2015.)

If sending in the wrong paperwork wasn’t enough to raise the ire of the CRA auditors, they certainly were not pleased when JNF Canada kept sending them receipts and files only in Hebrew, rather than in English or French, despite JNF Canada committing to provide translations.

While it is not illegal to have receipts and documents in a foreign language, it makes it difficult for auditors to do their work and get a reasonable sense of what is going on. As late as the fall of 2023, JNF Canada kept asking the government for more time to get this material translated.

JNF Canada also ran afoul of the Income Tax Act’s requirements that a charity’s physical records (and also digital ones), are to be kept in Canada.

The CRA kept waiting for JNF Canada to send in the required documents, but after such long delays, the auditors concluded that “records for activities undertaken in Israel were not kept in Canada during the audit period, nor currently.”

Were they overpaying Israeli workers?

In the CRA’s letter of June 26, 2024, much was made of the whole workers payment program and how it was being operated during the period from Jan. 1, 2011 to Dec. 31, 2012.

The auditors wondered why the labourers appeared to have earned way more money than their research showed regular minimum-wage workers in Israel were entitled to be paid at the time.

The CRA felt the hired labourers were overpaid by as much as $18,789 CAD above the average monthly minimum wage for 2011, and overpaid by as much as $19,738 above minimum monthly wages in 2012.

The letters do not make it clear whether auditors meant JNF Canada’s agent was overpaying each labourer by these amounts every month, or whether the amount calculated was the total monthly payroll or total yearly one.

In the end, the CRA was adamant that JNF Canada should not simply be a “conduit to funnel donations overseas”, but needed to show it was an independent charity protecting the interests of Canadian taxpayers.

Looking closely at expense accounts

As part of its examination of JNF Canada’s financial operations, the CRA took a closer look at why the charity reimbursed its Canadian-based administrators and staff a total of $404,244 for their business-related travel expenses in 2011-2012.

Despite the employees filling out forms showing their mileage for travel using personal cars, receipts for hotels and airfare and the like, the CRA auditors concluded the documents still weren’t detailed enough. They said they were missing categories such as the exact destination and purpose of the trip. So CRA couldn’t certify the staff was conducting work for charitable purposes.

JNF Canada conceded the point.

“By only designating cities rather than specific addresses in those cities, and by not outlining the purpose of the travel, its expense reports in 2011 and 2012 were lacking,” it told the CRA.

Charity officials promised to improve the reporting forms in the future.

Throwing the former CFO under the bus

While the auditors were deep into their investigation of the charity, they spent a lot of time asking questions to the top person in charge of financial matters at JNF Canada’s national office. The name has been blacked out.

But the documents reveal how JNF Canada started to complain in late 2023 that the director of finance at the time hadn’t been “qualified to answer many of the questions” or to speak for the organization. They felt he (or she) didn’t understand the charity’s purpose, activity and goals, and as such had given the auditors wrong information.

The CRA was skeptical. The agency wrote back in June 2023 that this was the first time anyone at JNF Canada had even raised doubt about the competency of their former top management. As a result, the CRA wasn’t buying the charity’s late-inning objection.

After all, the auditors expected the person who was director of finance at the time would be “well versed about the financial operations of the Organization.”

Once again, JNF Canada was told, “these concerns now being raised by the Organization do not sway the [Charities Directorate]’s and or findings with respect to the repeated and serious non-compliance with the Act.”

Projects linked to the IDF and on ‘Occupied Territories’

In its full report on the 2014 audit, the tax department examined at least 17 projects that either indirectly or directly helped the Israel Defense Forces or were built in areas of the West Bank including East Jerusalem or in the Golan Heights.

While the CRA permits charities to operate anywhere in the world, and doesn’t explicitly forbid charities from working in the West Bank, officials say they are bound to follow Canadian government policy on the issue, which is set by Global Affairs Canada.

“It is our position that establishing and maintaining physical and social infrastructure elements and providing assistance to Israeli settlements in the Occupied Territories serves to encourage and enhance the permanency of the infrastructure and settlements, and appears to be contrary to Canada’s public policy and international law on this issue,” the CRA wrote.

The CRA’s final revocation notice published Aug. 10, 2024 doesn’t mention anything about the controversial support for Israel’s military or Israel’s occupation of Palestinian land.

However, the newly released CRA documents reveal for the first time the extent to which the charity watchdog dug into the controversial projects. News reports in 2019 were published containing some of the information, and sparked public condemnation of JNF Canada at the time.

In her report sent to the JNF Canada team on April 19, 2016, the CRA’s Sandra Burke told them they were not permitted to fund work in areas that violated Canadian foreign policy in the Middle East.

She singled out Canada Park, the flagship, Canadian-funded JNF forestry project now known as Ayalon Park between Jerusalem and Tel Aviv. Canadian JNF donors helped develop this popular 3,200-hectare nature park with some $15 million in the 1970s, and continued to support it financially with refurbishments in 2007 and again in 2012.

Critics have charged the KKL with constructing the site on top of three demolished Palestinian villages, and refusing to permit Arab residents to return to their old homes.

In 2012, the park was renamed for Toronto real estate developer and philanthropist Miles Nadal, who was hailed as a keystone contributor.

The documents showed seven other JNF Canada projects that CRA considered inappropriate, as they are located in the West Bank, in East Jerusalem and in the Golan Heights.

In the Golan:

- Jordan Park

- Naftali Mountains Forest

- Avnei Eitan

In the West Bank:

- The Alexander Zeymar River, which runs from the Palestinian city of Nablus to Emek Hefer

- The Western Wall Tunnels in East Jerusalem

- Reforestation of Mount Scopus

- The Oz Ve’Gaon settlement outpost, named for three Israeli teens murdered by Hamas in 2014.]

JNF Canada told The CJN it no longer financially supports projects built in the West Bank, in order to cooperate with the CRA.

Concern over funding IDF bases

The 2018 letter from auditors also listed JNF Canada’s financing of nine projects that the CRA considered helped the Israel Defense Forces, which is definitely not permitted.

“Increasing the effectiveness and efficiency of Canada’s armed forces is charitable, but supporting the armed forces of another country is not,” the CRA told them.

The CRA’s list included:

- An outdoor fitness area at an Army training facility in Sde Boker housing high school students who take a week long Gadna program before they join up

- Landscaping at the IDF’s largest army base, Tze’elim; installing play facilities for the children of personnel at the IDF air force base in Tel Nof, in a project named in honour of donors Fred and Linda Waks of Toronto

- A recreation centre, mess halls, a kitchen and an auditorium for IDF personnel

The late Calgary philanthropist Jack Balaban’s donation to build a basketball facility at a yeshiva in Kiryat Shmona also came under scrutiny, as it is located on the campus for serving IDF personnel who can continue their religious studies while in uniform.

Where does JNF Canada stand now?

The blue-and-white coin collection boxes, which have synonymous with the Jewish community’s commitment to philanthropy, can still be found in many Jewish households across Canada.

For now, though, the charity can no longer issue tax receipts for donations.

JNF Canada is determined to continue operating as a non-profit, and is pushing ahead with its full calendar of fundraising events. These include two missions to Israel this fall, a baseball game in Calgary, a breakfast at Camp Massad in Winnipeg Beach featuring activist Aviva Klompas, and two marquee Negev dinners. The Toronto dinner on Nov. 10 features former Israeli prime minister Naftali Bennett and American journalist Bret Stephens as speakers. JNF Ottawa supporters will honour local Conservative MPP Lisa Macleod on Nov. 13.

According to the charity’s website, JNF Canada committed in 2021 to raise another $100 million by 2028 from a wider base of Canadian donors.

As part of the Aug. 10 revocation, JNF Canada has filed two legal challenges in court.

The first came before, on July 24, with an application to the Federal Court of Appeal in Toronto asking to altogether overturn the charitable status revocation.

The second legal challenge, an appeal for a quicker judicial review of the agency’s decision, was filed later with the Federal Court, on Aug. 20, 2024. Through this alternate avenue, JNF Canada is requesting the court refer the CRA’s decision back for reconsideration to a different CRA official, or to retract the revocation while the matter is before the courts.

JNF Canada feels the tax agency unfairly skipped some steps in its usual process of guiding charities toward compliance, and pulled the trigger.

Meanwhile, JNF Canada launched a petition, as well as a social media campaign to garner political support, with officials claiming that they had been “blindsided” by the Aug. 10 move, which they point out was published over Shabbat, and came after the charity’s legal actions had already commenced.

In a letter to supporters on Aug. 13, JNF Canada CEO Lance Davis and national president Nathan Disenhouse asked community members to write the minister of national revenue, Quebec MP Marie-Claude Blais, to restore JNF Canada’s status while it appeals CRA’s decision through the courts. The petition against what JNF calls “targeted bias” has now gathered more than 11,000 signatures.

Author

Jonathan Rothman is a reporter for The CJN based in Toronto, covering municipal politics, the arts, and police, security and court stories impacting the Jewish community locally and around Canada. He has worked in online newsrooms at the CBC and Yahoo Canada, and on creative digital teams at the CBC, and The Walrus, where he produced a seven-hour live webcast event. Jonathan has written for Spacing, NOW Toronto (the former weekly), Exclaim!, and The Globe and Mail, and has reported on arts & culture and produced audio stories for CBC Radio.

View all posts